snohomish property tax payment

Sign up for PAPERLESS BILLING for future tax statements. The Assessor and the Treasurer use the same software to record the value and the taxes due.

Property Taxes Rise For Most Of Snohomish County In 2020 Heraldnet Com

Users can also make payments to Snohomish County using Paystation without logging on.

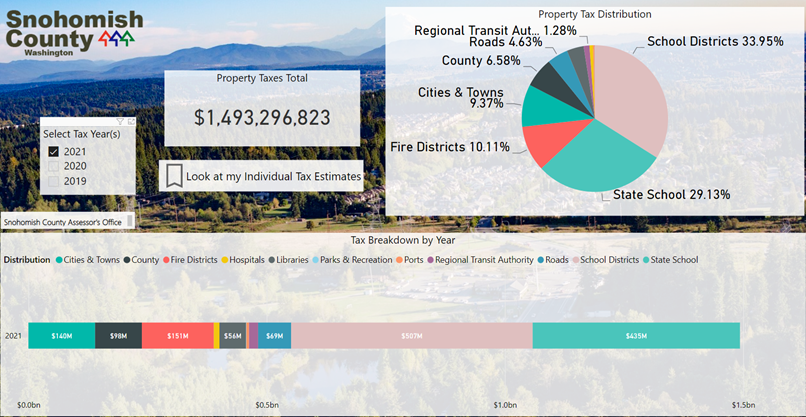

. Based on that 089 rate Snohomish County homeowners can expect to pay an average of 3009 a year in property taxes. 84360301 community social service. View your online tax statement.

Pay for services online. Point Pay Support. Email the Treasurers Office with your parcel information and the new address information.

Click for Instructions. Pay online for free using your checking account and the Personal Identification Number PIN which is printed on the Annual Property Tax Bill. Snohomish County collects on average 089 of a propertys assessed fair market value as property tax.

Interest continues to accrue until the taxes are paid in full. Ad Find Out the Market Value of Any Property and Past Sale Prices. Median Property Taxes Mortgage 3638.

For more information please visit the web pages of Snohomish Countys Assessor and Treasurer or look up this propertys current valuation and tax situation. The following links maybe helpful. If you or someone you know is a senior citizen disabled or has a fixed or limited income there are several programs available to help you reduce the amount of property taxes you owe.

Snohomish County has one of the highest median property taxes in the United States and is ranked 155th of the 3143 counties in order of. If you pay the first half of your taxes by April 30th but fail to pay the second half by October 31st the unpaid portion is subject to 1 interest per month. Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs.

Make a one time payment below using your Parcel ID OR use the Create an account link to make future payments easier. How do I pay property taxes in Snohomish County. Offered by County of Snohomish Washington.

425-262-2469 Personal Property. Snohomish County Property Tax Payments Annual Snohomish County Washington. New Functionality for 2016- SEE YOUR TAX STATEMENT ONLINE.

Pay the county now. Snohomish Countys average tax rate is 089 of assessed home values which is well below the national average of 11 and slightly below the Washington statewide average of 092. This year the income thresholds and residency requirements for the Senior CitizenDisabled Persons.

Snohomish County Tax Records Report Link. 2022 Point Pay. Monday February 28 2022 130am.

In case you missed it the link opens in a new tab of your browser. Tax Statements are Mailed to the Property Taxpayer of Record. Volunteers of america - everett po box 839 everett wa 98206-0839.

Snohomish County Treasurer Payments. The Treasurer calculates the taxes due and sends out the tax notices using the taxing district information. NO personal or business checks NO online website credit or debit card payments will be accepted.

Each electronic check transaction is limited to 99999999. Snohomish City Council shouldnt give developers tax breaks. Snohomish County Property Tax.

Is the service provider for the Snohomish County EBPP Electronic Bill Presentment. This applicant would be exempt from property tax if they owned the property effecitve 712011. Discover Snohomish County Property Tax Payments for getting more useful information about real estate apartment mortgages near you.

1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. 2801 lombard everett. If your taxes are still delinquent on June 1st you are subject to a 3 penalty.

Cash cashiers check and money order are the ONLY acceptable form of payment. Use the search tool above to locate your property summary or pay your taxes online. To make a payment now go to Make Online Payment.

During the months of April and October you will drop tax payments in the secure drop box. During the months of April and October you will pay your taxes by cash check money order debit or credit card at the Snohomish County Administration East buildings front door. Make one time payments eCheck or credit card.

Median Property Taxes No Mortgage 3534. The median property tax in Snohomish County Washington is 3009 per year for a home worth the median value of 338600. Enter your Parcel Full Name exactly as it appears on your statement and statement date the system will then lookup your account and present the amount owed.

Please take a moment to view or convenient tax payment options. Snohomish city government is awash with money from local state and federal. Fill out the form on the back of your tax statement and mail it with your payment in the envelope provided.

Paystation Online Bill Presentment and Payment Benefits Summary.

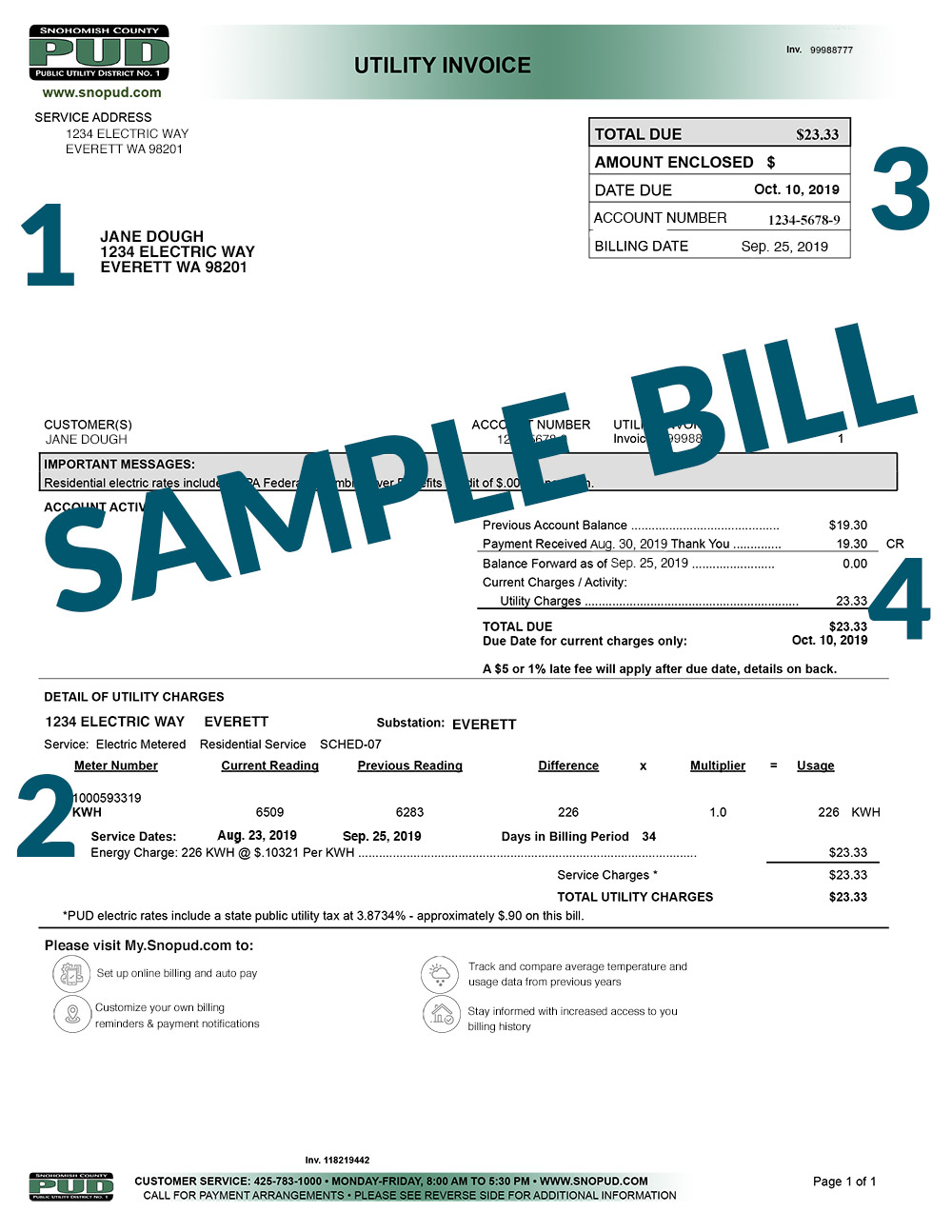

How To Read Your Property Tax Statement Snohomish County Wa Official Website

Snohomish County Camano Association Of Realtors Home Facebook

Tax Payment Options Snohomish County Wa Official Website

Snohomish County Treasurer Payments

News Flash Snohomish County Wa Civicengage

My Billing Statement Snohomish County Pud

United Way Of Snohomish County S Free Tax Preparation Site Opens In Lynnwood Lynnwood Today

What S Next For Lynnwood Link Sound Transit Updates Council On Light Rail Schedule Lynnwood Today Light Rail Map Lynnwood

What Snohomish County Would Pay And What St3 Would Deliver Heraldnet Com

Graduated Real Estate Tax Reet For Snohomish County

About Efile Snohomish County Wa Official Website

Tax Payment Options Snohomish County Wa Official Website

Snohomish County Camano Association Of Realtors Home Facebook

How To Read Your Property Tax Statement Snohomish County Wa Official Website

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Snohomish County Camano Association Of Realtors Home Facebook

Property Taxes And Assessments Snohomish County Wa Official Website

How To Read Your Property Tax Statement Snohomish County Wa Official Website